We talked to Gary Reynolds about the three areas he’s focused on this period: the Magnificent Seven (Mag-7), UK Growth and US tariffs and the market’s reaction to them all. If you haven’t seen, we published pieces on the Mag-7 and UK Growth earlier this month, and will publish a deeper piece on US Tariffs soon. In the meantime, here are Gary’s thoughts and a summary of the interview.

The Magnificent Seven (Mag-7)

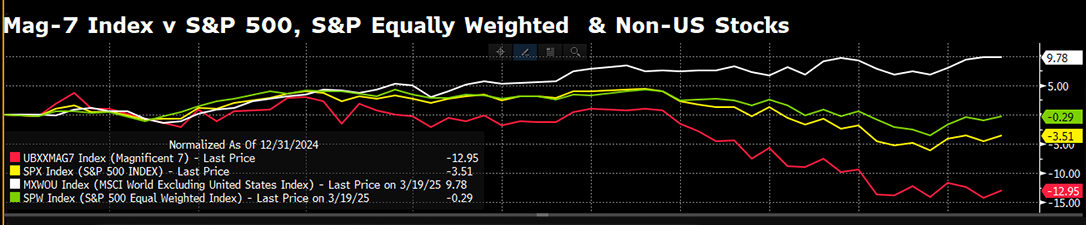

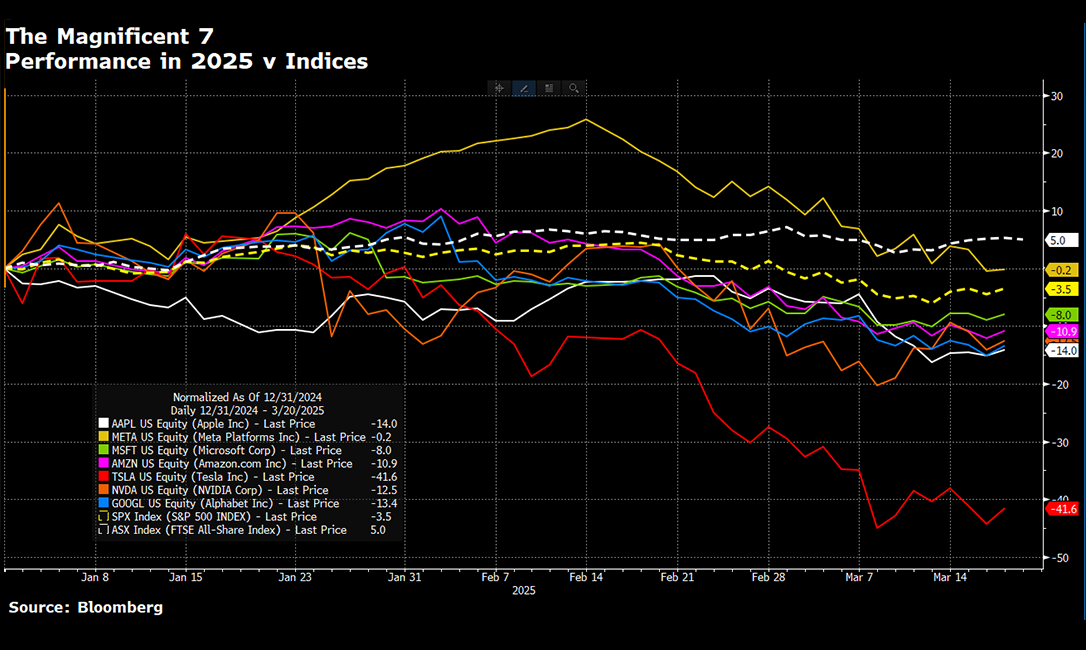

The Mag-7 collectively performed well in 2023, but they are expected to underperform in 2025. Gary emphasises the tendency of investors to drive up asset values due to fear of missing out, which can lead to bubbles. This is reminiscent of the tech bubble in the late 90s, however, Gary notes that at least the Mag-7 companies generate profits, unlike many tech companies from the 90s!

With competition from new companies, the impact of China’s electric car market and other challenges, Reynolds uses the analogy of the film ‘The Magnificent Seven’ to suggest that only a few of these companies will continue to thrive in the long term. The trick, if you are invested in the Mag-7, is to know which companies will last.

Read more about Gary’s thoughts on the Mag-7

US Market Reactions and Tariffs

Gary thinks that the impact of tariffs imposed by Trump may come back on the US economy. He explains the concept of tariffs and their potential effects on prices and inflation, as well as the economic principle of comparative advantage. In general, he argues that tariffs are detrimental to the economy, with tariffs either affecting consumer prices or denying countries the specialisations delivered in global trade. Tariffs could spoil the positive aspects of the US economy, which he believes is already great.

UK Growth and Economic Outlook

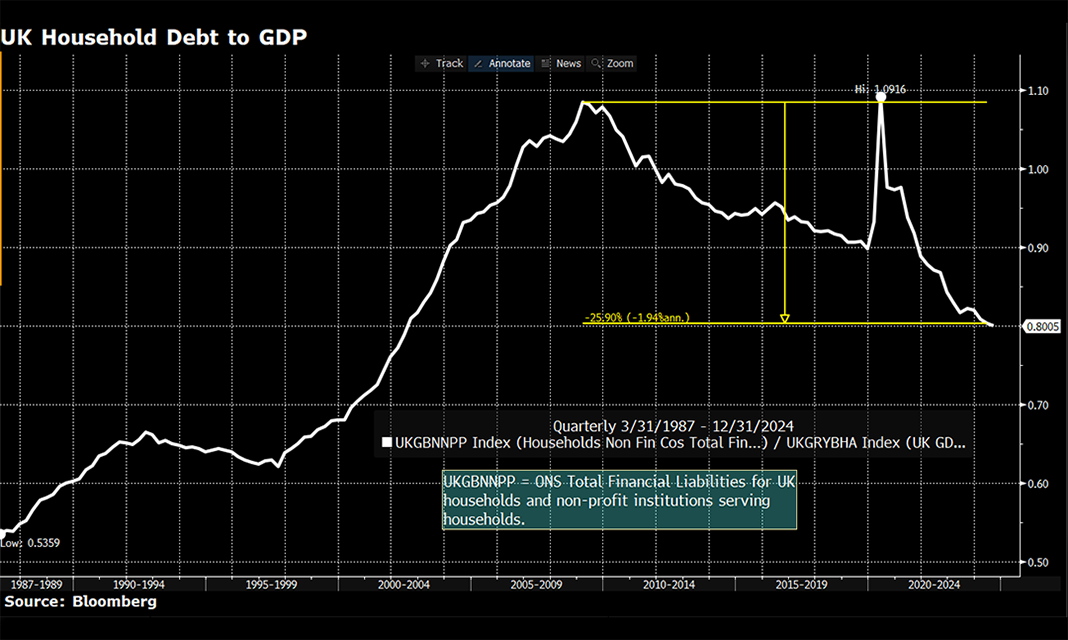

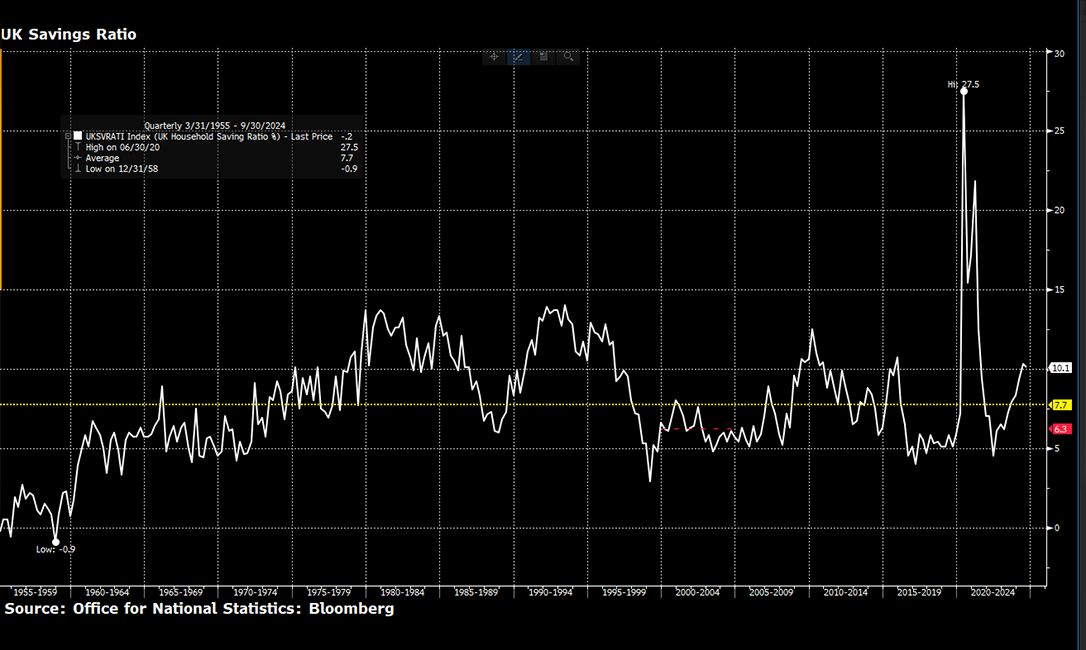

Reynolds critiques the UK government’s handling of economic growth, particularly the October budget, which he describes as a ‘car crash’. He emphasises the importance of consumer confidence and spending for economic growth, because if the average consumer is not confident in the economy, they are more likely to save, slowing growth down. You can see this happening in the fact that the current savings rate in the UK is higher than the long-term average, indicating pessimism amongst consumers.

To fix this, Gary suggests reducing the savings rate and increasing consumption; this could boost the economy. Reynolds also discusses the potential for households to leverage more debt to stimulate growth. Above it all, Gary expresses optimism about the ingenuity of the British people and the potential for positive change, despite his concerns about the government’s current approach.